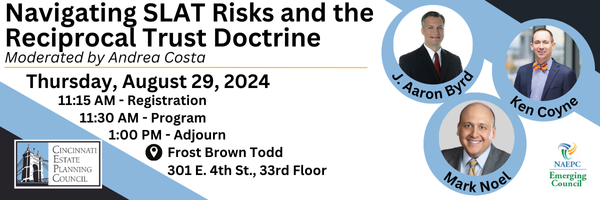

Navigating SLAT Risks and the Reciprocal Trust Doctrine

Date: Thursday, August 29, 2024

Time: 11:30am - 1:00pm

Location: Frost Brown Todd, 301 E. 4th Street, 33rd Floor

Speaker: J. Aaron Byrd, Ken Coyne & Mark Noel

Add to My Outlook Calendar

Add to My Google Calendar

|

THIS EVENT IS SOLD OUT. IF YOU WOULD LIKE TO BE ADDED TO A WAITLIST, PLEASE EMAIL YOUR NAME AND CONTACT INFORMATION TO US AT ADMINISTRATION@CINCINNATIESTATEPLANNINGCOUNCIL.COM.

Aaron Byrd, Ken Coyne, and Mark Noel will join us from 11:30 am to 1 pm on Thursday, August 29th for a lunchtime panel discussion followed by Q&A on navigating Spousal Lifetime Access Trusts (SLATs) and the reciprocal trust doctrine. The panelists will share their individual views on utilizing SLATs to optimize transfer tax planning and asset protection. They will highlight key considerations for avoiding the reciprocal trust doctrine and other risks associated with incorporating one or more SLATs into an estate plan. Attendees can expect valuable insights into structuring SLATs as we approach 2025 and the potential sunset of the Tax Cuts and Jobs Act.

We hope to see you there!

Board of Directors, Cincinnati Estate Planning Council

|

|

|

Date:

Thurs., August 29, 2024

Time:

11:15 AM - Registration

11:30 AM - Program

1:00 PM - Adjourn

Cost:

Members - $15.00

Non-Member - $35.00

|

|

|

Location:

Frost Brown Todd

301 East Fourth Street

33rd Floor

Cincinnati, OH 45202

Deadline to Register:

MONDAY, AUGUST 26TH

Note: refunds will not be given for cancellations received after the registration deadline.

|

|

|

APPROVED CEU Credits

CFP

CPA

KY Legal

OH Insurance

OH Legal

|

|

|

2024-2025 Season Sponsor

We are proud to welcome the

Greater Cincinnati Foundation back as our season sponsor!

|

|

|

|

Aaron Byrd

Frost Brown Todd

Aaron Byrd is a partner at Frost Brown Todd where he led the firm-wide Estate Planning team for many years. He concentrates his practice on multigenerational planning for business owners and families in need of estate tax, gift tax, and generation-skipping transfer taxation counsel. Aaron is a graduate of the United States Military Academy at West Point and for his combat service in Iraq, Aaron was awarded the Bronze Star Medal. Aaron is a proud NKU Chase Law graduate and is identified in The Best Lawyers in America© in the Trusts & Estates category.

|

|

Ken Coyne

Graf Coyne

Ken Coyne is a former CEPC president (2015-16) and named partner at Graf & Coyne. He has extensive experience in estate planning, estate administration, fiduciary counsel, and estate & gift tax controversy. Until 2020, Ken and his partner, Bill Graf, also taught the Cincinnati Bar Association’s Advanced Estate Planning & Drafting Course. Ken is a graduate of Miami University and earned his law degree at Emory University. Ken is also a Fellow of the American College of Trust and Estate Counsel (ACTEC), which is a national association of peer-elected trust and estate attorneys.

|

|

Mark Noel

Porter Wright

Mark Noel is an adjunct professor of estate planning for the University of Cincinnati College of Law. He is a partner at Porter Wright, and he focuses his practice on trust and estate matters, including estate, gift and GST tax planning. Mark has been identified as an Ohio Super Lawyers© Rising Star, and he is a current member of the CEPC board of directors. Mark is a graduate of University of Kentucky and also earned his law degree at the University of Kentucky. He also holds an LL.M. in Estate Planning from the University of Miami School of Law in Coral Gables, Florida.

|

|

|

|

|

See Upcoming Event Calendar